tax saving tips for high income earners uk

Top up your pension. Delay receiving income to avoid paying tax in the current financial year.

7 Roth Ira Advantages In Saving For Retirement Inside Your Ira Many Americans See A Roth Ira As A G Roth Ira Saving For Retirement Investing For Retirement

Personal Wealth Awards.

. Use your partners Tax Free Allowance. One of best ways for high earners to save on taxes is to establish and fund retirement accounts. Consider salary sacrificing to reduce your taxable income.

Here its fairly simple. UK 350 Risers and Fallers. Prepay tax-deductible expenses to bring your tax deduction forward.

Since 2001 the Shares Awards have recognised the high quality of service and products from companies in the world of retail investment as voted for by Shares readers. Change the Character of Your Income. A financial adviser can help you to avoid any unexpected tax bills that may result from accidental breaches of the cap.

You can deduct the amount you. In Germany high earners pay more tax but receive much better benefits. Your Personal Allowance goes down by 1 for every 2 that your adjusted net income is above 100000.

It is possible to carry over this 5 allowance from one year to the next even up to 100 after twenty years. Saving and investing within an ISA is another tax-efficient strategy for high earners to. If you are considered to be a high-income individual and have an adjusted income of more than 150000 per year and a threshold income of more than 110000 per year your annual allowance will be tapered.

Marginal bands mean you only pay the specified tax rate on that. If you are a taxpayer living in England or Wales you will pay 40 income tax for an income of over 50270 assuming a full personal allowance is available. Tax relief is paid on your pension.

Using your full Individual Savings Accounts ISAs allowance should be your first port of call. One of the most effective ways for high earners in the UK to build wealth. So you can earn a total of 18570 from income and savings interest without paying any tax.

Health savings account contributions. HSAs are triple tax-advantaged accounts. Also offering high returns elss funds assistance in saving tax.

Make spousal contributions to reduce your tax liability. Make the most of the savings allowances the first 1000 of savings income is tax free for basic rate taxpayers or 500 for higher rate taxpayers under the personal savings allowance. If you are an employee and you have an employer-sponsored 401k or 403b in 2018 you can contribute up to 18500 per year of your gross income.

Use your full ISANISA allowance. Tax saving tips for high income earners. Regardless of whether you are an.

For the 202223 tax year if you live in England Wales or Northern Ireland there are three marginal income tax bands the 20 basic rate the 40 higher rate and the 45 additional rate also remember your personal allowance starts to shrink once earnings hit 100000. If you partner has tax free personal allowances which they are not using transfer some of your assets to them or if you run your own limited company employ them. A high earner in Germany who is made unemployed can claim 60 of their former income for up to two years up to a maximum.

Anyone with a taxable income of more than 240000 will also see the annual allowance for their pension tapered for every 2 of income earned over 240000 their annual allowance is reduced by 1. High earners should invest the maximum in a 401 k or 403 b. How to reduce taxable income for high earners.

You benefit from both the 5000 starting savings allowance where you pay 0 tax plus the personal savings allowance of 1000. Consider your tax status as a couple. Tax-saving tips for higher earners.

For income levels between 273000 and 300000 it will be between 34 and 19 and for income levels above 300000 the saving will be 19. But with big money can come big taxes. High earner tax planning.

These changes are significant because they make it possible for high-income earners to make additional contributions to a retirement plan during the tax year. One way to reduce your tax burden is to change the character of your income. Here are five tax saving tips that are easy to apply.

50 best ways to reduce taxes for high income earners. Eight ways to shield your hard-earned money from the taxman. You earn between 12570 and 17570.

Currently 3600 can be invested each year. Do you earn a lot of money. This means your allowance is zero if your income is 125140 or.

Here are 50 tax strategies that can be employed to reduce taxes for high income earners. The contribution you will make will come straight out of your. For 201920 the annual pension contribution limit for tax relief purposes is 100 of your salary or 40000 whichever is lower.

Scottish taxpayers will continue to be subject to income tax at 5 different rates ranging from 19 Starter Rate to 46 Top Rate for any income in excess of 150000. If you are considered to be a high-income individual and have an adjusted income of more than 150000 per year and a threshold income of more than 110000 per year your annual allowance will be tapered. Contributions are tax-deductible the money grows tax-free and withdrawals are tax-free for qualified medical expenses for those under age 65 and for any purpose if you are age 65 or over.

Fortunately there are many ways high earners can reduce the taxes on their income. Hold investments in a discretionary family trust for tax-effective income distribution. Use your Spare room - New income and Tax Savings.

50 Best Ways to Reduce Taxes for High Income Earners. For 201920 the annual pension contribution limit for tax relief purposes is 100 of your salary or 40000 whichever is lower. Save and invest within ISAs.

Get in quickly. Tax Saving Strategies for High-Income Earners. Annual withdrawals of up to 5 of the original bond purchase price can then be made tax-free with income tax becoming due on withdrawals exceeding 100 of that original price.

You can find it on your payslip. 28 September 2017. Financial planning tips for high earners Make the most of your pension allowances.

How Do High Income Earners Reduce Taxes Australia Ictsd Org

Improving Lives With Financial Education Www Persestring Ca Financial Education Education Financial

Financial Tips For The Self Employed Financial Tips Credit Card Hacks Finance Tracking

Pin On Best Of The Millennial Budget

Free Childcare In Scotland How To Guide Childcare Childcare Costs Early Learning

How Can 7 Figure Income Earners Save On Income Taxes Quora

529 Ira Roth Ira Hierarchy For Tax Savings Michael Kitces Financial Planning Savings Strategy Financial Planning Hierarchy

10 Surefire Tax Tips For Year End 2021

Tax Minimisation Strategies For High Income Earners

These Are The Penalties For Filing Taxes Late Filing Taxes Tax Deadline Tax Time

10 Ways To Reduce Your Tax Bill Frazer James Financial Advisers

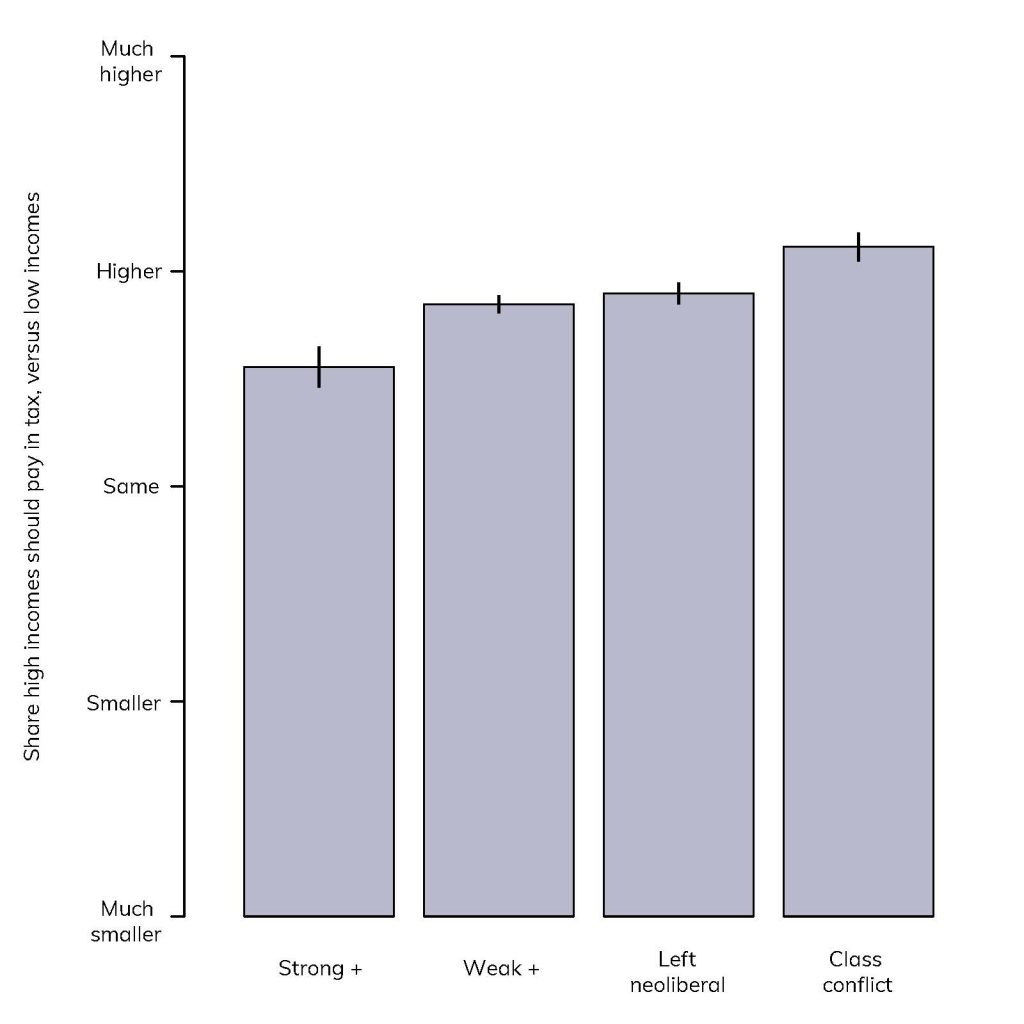

Progressive Taxation The Effects Of Perception On Public Opinion The Loop

High Income Earners Fail To Appreciate The Math Of 529 Plans Part Ii Resource Planning Group 529 Plan Saving For College Retirement Savings Plan

Tax Planning Strategies For High Income Earners The Private Office

How To Do Backdoor Roth Ira Roth Ira Roth Ira Contributions Finance

Retirement Options For High Income Earners Canaccord Genuity

Saver S Credit How To Get Free Money To Save For Retirement Saving For Retirement Free Money Savers

Understanding The Mega Backdoor Roth Ira Roth Ira Roth Ira Investing Personal Finance Budget